Your Income summary normal balance images are available. Income summary normal balance are a topic that is being searched for and liked by netizens today. You can Download the Income summary normal balance files here. Download all free photos.

If you’re looking for income summary normal balance pictures information connected with to the income summary normal balance interest, you have visit the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

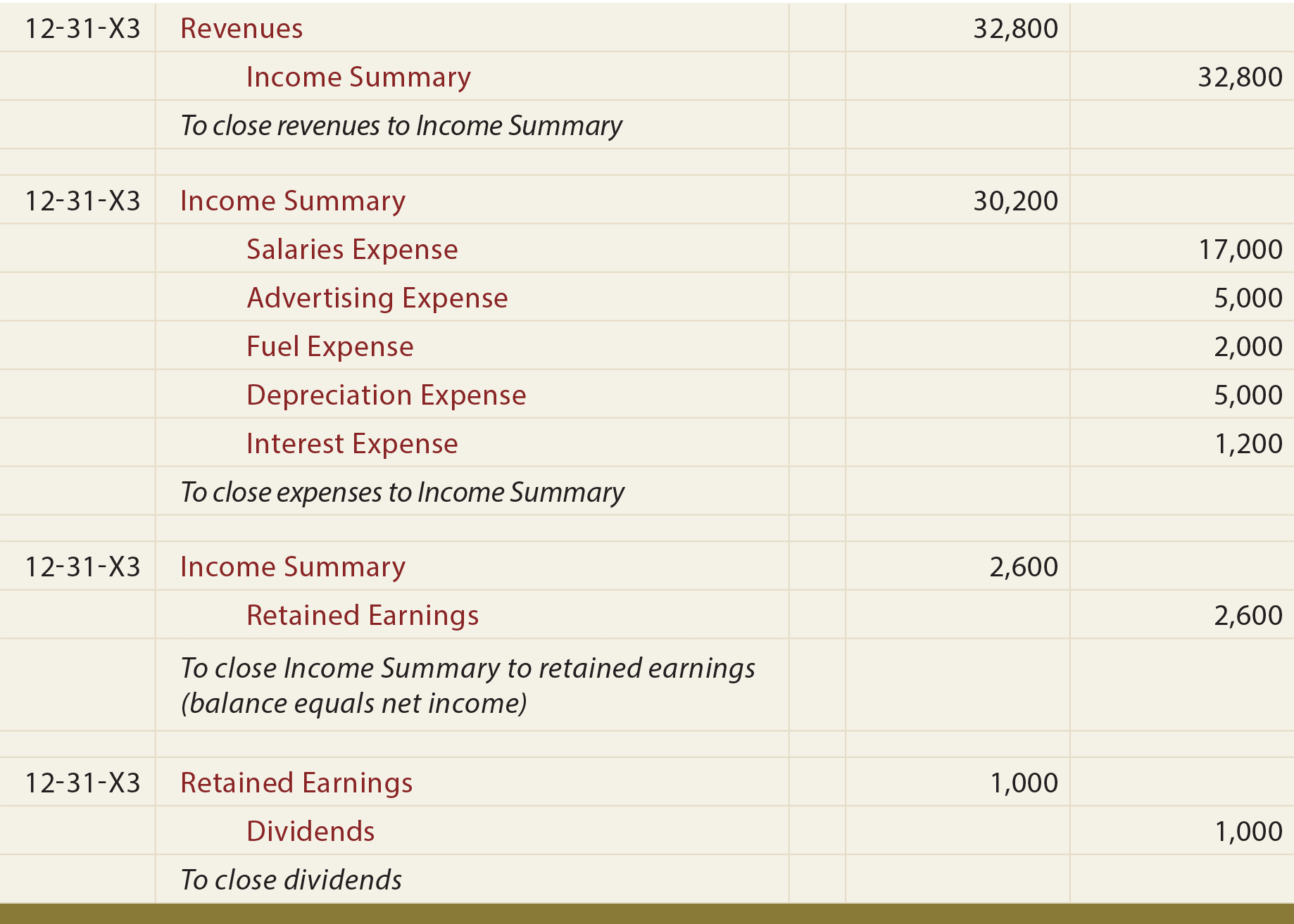

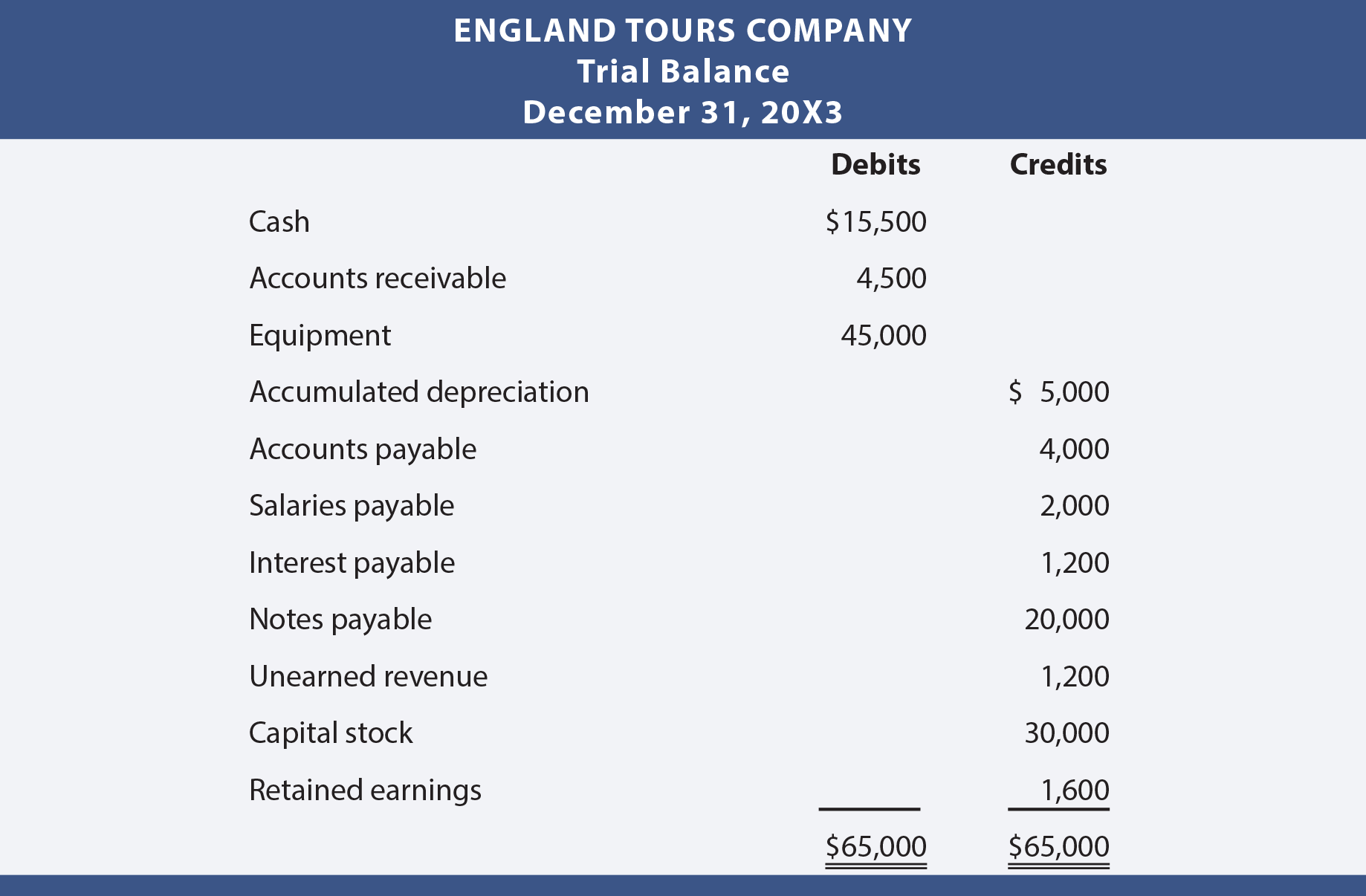

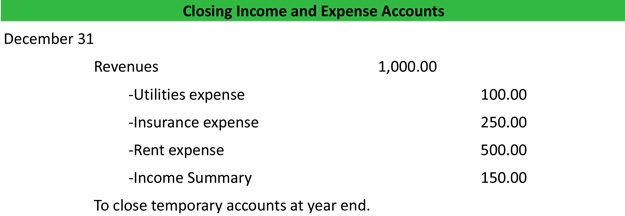

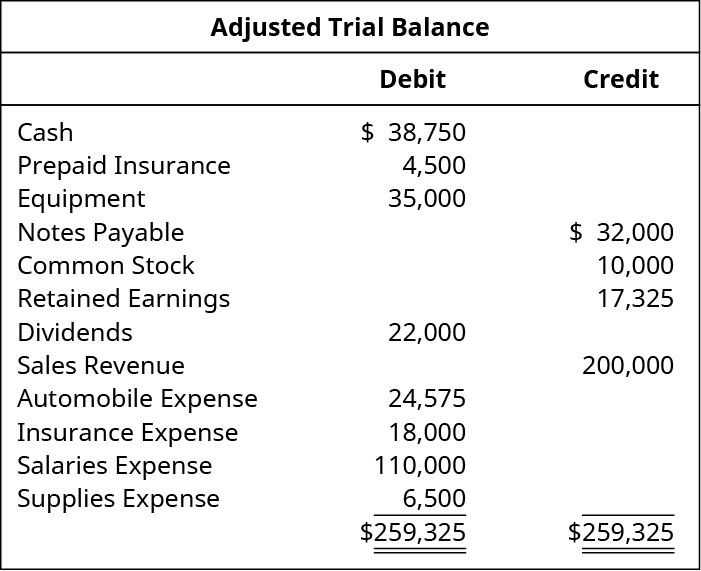

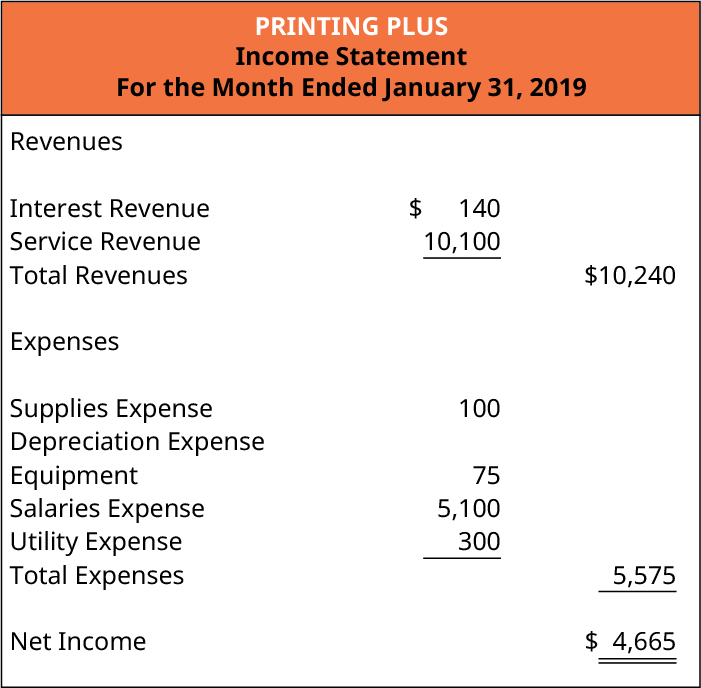

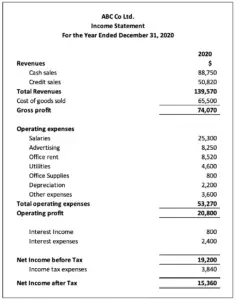

Income Summary Normal Balance. Income Summary allows us to ensure that all revenue and expense accounts have been closed. The Income Statement The information in your income summary entries comes from the income statement. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Answer Correct answer is Sales Sales has a normal credit balance and a closing entry required to transfer sales account to income summary account will require following entry Date General Journal Debit Credit Sales Income s.

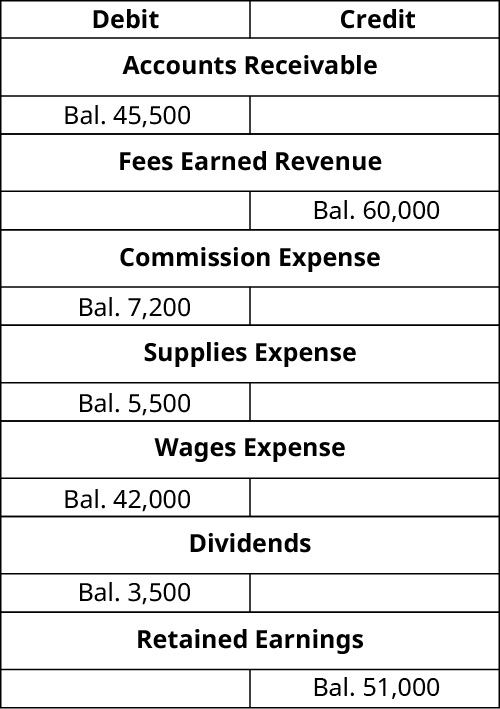

What is Income Summary. Others will argue however that based on the definition of normal balance the balance expected of a particular account Income Summary can be said to have no normal balance. To be more specific it is. One way to do this is to use an income summary account. The Income Summary account has a normal debit balance. Temporary accounts or nominal accounts include all of the revenue accounts expense accounts the owners drawing account and the income summary account.

In bookkeeping the Income Summary account falls into the Income Statement category of accounts and is only used at the end of the time period to close everything out.

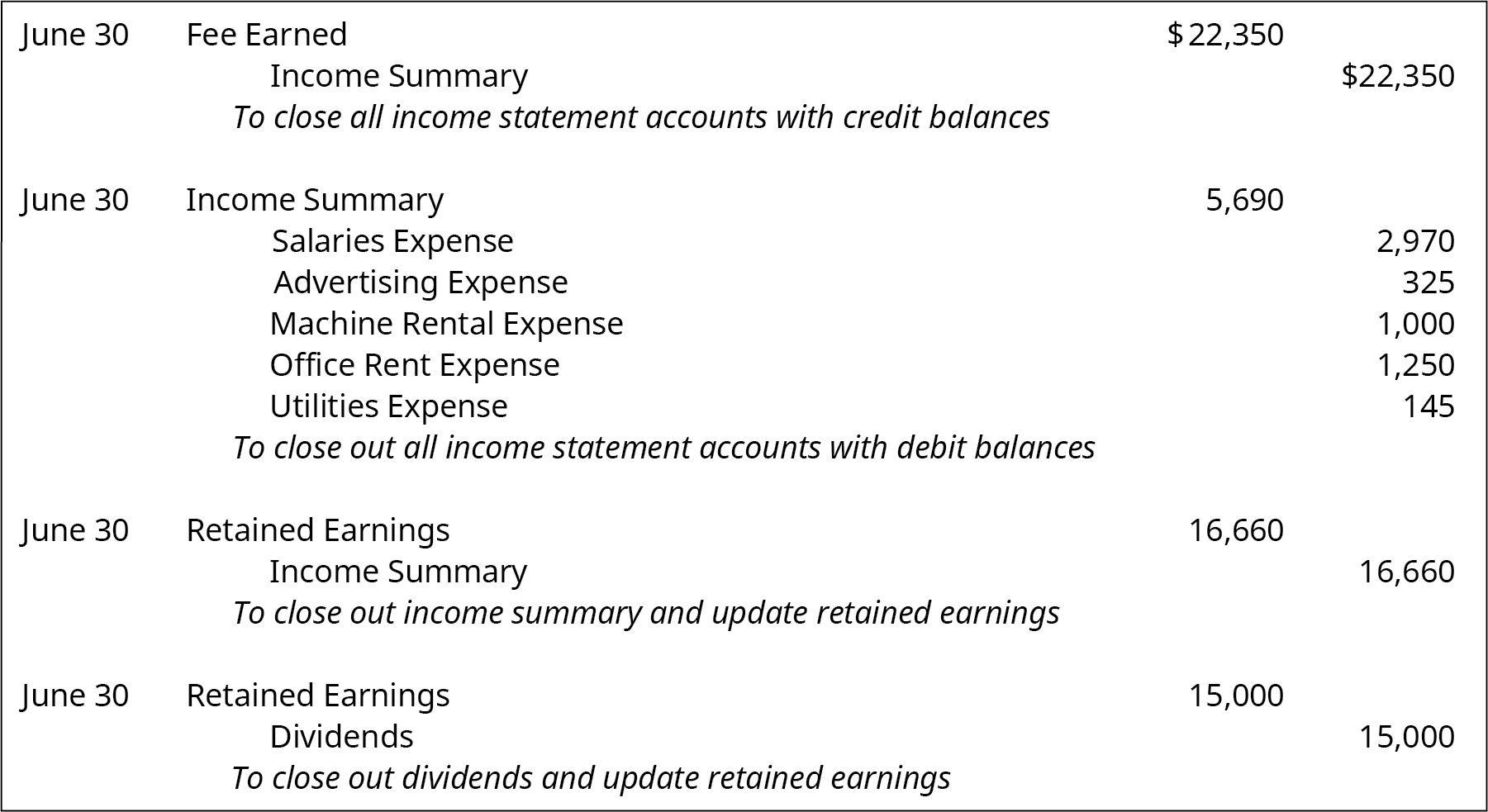

The revenue remaining after deducting all expenses or net income makes up the retained earnings part of shareholders equity on the balance sheet. The classification and normal balance of the drawing account is the owners equity with a debit balance. The net amount transferred into the income summary account equals the net profit or net loss that the business incurred during the period. Secondly how do you close Income Summary. The Income Summary will be closed with a debit for that amount and a credit to Retained Earnings or the owners capital account. Social Science Economics Finance Accounting Chapter 10 checking-for understanding STUDY Flashcards Learn Write Spell Test PLAY Match Gravity Which accounts are considered temporary accounts.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual. Content Typical Balance Exercises Or Exergames For Balance Improvement. The Income Summary account is located in the owners equity section of the general ledger. The Income Summary account is a permanent account. One way to do this is to use an income summary account.

Source: principlesofaccounting.com

Source: principlesofaccounting.com

This income balance is then. The classification and normal balance of the drawing account is the owners equity with a debit balance. The first accounts to close are the revenue accounts. On the other hand expenses and withdrawals decrease capital hence they normally have debit balances. Income Summary allows us to ensure that all revenue and expense accounts have been closed.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

The income summary account is a temporary account into which all income statement revenue and expense accounts are transferred at the end of an accounting period. The classification and normal balance of the drawing account is the owners equity with a debit balance. Used to accumulate and summarize the revenue and expenses for the period. Revenue accounts are closed by making a debit entry to the account and a credit entry to Income Summary. On the other hand expenses and withdrawals decrease capital hence they normally have debit balances.

Temporary accounts or nominal accounts include all of the revenue accounts expense accounts the owners drawing account and the income summary account. To calculate the income summary simply add them together. Thus you will never see it on any financial statements nor does it have any normal balance sign. Income Summary allows us to ensure that all revenue and expense accounts have been closed. The classification and normal balance of the drawing account is the owners equity with a debit balance.

Source: opentextbc.ca

Source: opentextbc.ca

The first accounts to close are the revenue accounts. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Generally speaking the balances in temporary accounts increase throughout the accounting year. A balance sheet is a summary of a. In bookkeeping the Income Summary account falls into the Income Statement category of accounts and is only used at the end of the time period to close everything out.

Source: pinterest.com

Source: pinterest.com

The Income Summary account is used throughout the accounting period. The revenue remaining after deducting all expenses or net income makes up the retained earnings part of shareholders equity on the balance sheet. Example of Income Summary Account. What is Income Summary. In a manual accounting system the.

The first accounts to close are the revenue accounts. On the other hand expenses and withdrawals decrease capital hence they normally have debit balances. The revenue remaining after deducting all expenses or net income makes up the retained earnings part of shareholders equity on the balance sheet. The trial balance above only has one revenue account Landscaping Revenue. The Income Statement The information in your income summary entries comes from the income statement.

Source: quizlet.com

Source: quizlet.com

Close the revenue accounts to Income Summary. Next the balance resulting from the closing entries will be moved to Retained Earnings if a corporation or the owners capital account if a sole proprietorship. The classification and normal balance of the drawing account is the owners equity with a debit balance. Temporary accounts or nominal accounts include all of the revenue accounts expense accounts the owners drawing account and the income summary account. Income has a normal credit balance since it increases capital.

Source: opentextbc.ca

Source: opentextbc.ca

On the other hand expenses and withdrawals decrease capital hence they normally have debit balances. Next the balance resulting from the closing entries will be moved to Retained Earnings if a corporation or the owners capital account if a sole proprietorship. Income has a normal credit balance since it increases capital. Expense accounts however have a normal debit balance and decrease shareholders equity through retained. What is Income Summary.

Source: opentextbc.ca

Source: opentextbc.ca

On the other hand expenses and withdrawals decrease capital hence they normally have debit balances. Click card to see definition Revenue expense and owners withdrawal. In a manual accounting system the. Others will argue however that based on the definition of normal balance the balance expected of a particular account Income Summary can be said to have no normal balance. Thus you will never see it on any financial statements nor does it have any normal balance sign.

Source: pinterest.com

Source: pinterest.com

The trial balance above only has one revenue account Landscaping Revenue. Income has a normal credit balance since it increases capital. If the Income Summary has a debit balance the amount is the companys net loss. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Revenue accounts have a normal credit balance and increase shareholders equity through retained earnings.

Example of Income Summary Account. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. Others will argue however that based on the definition of normal balance the balance expected of a particular account Income Summary can be said to have no normal balance. Social Science Economics Finance Accounting Chapter 10 checking-for understanding STUDY Flashcards Learn Write Spell Test PLAY Match Gravity Which accounts are considered temporary accounts. The trial balance above only has one revenue account Landscaping Revenue.

Source: pinterest.com

Source: pinterest.com

Expense accounts however have a normal debit balance and decrease shareholders equity through retained. Secondly how do you close Income Summary. The Income Statement The information in your income summary entries comes from the income statement. A balance sheet is a summary of a. Others will argue however that based on the definition of normal balance the balance expected of a particular account Income Summary can be said to have no normal balance.

Source: accountinguide.com

Source: accountinguide.com

One way to do this is to use an income summary account. Temporary accounts or nominal accounts include all of the revenue accounts expense accounts the owners drawing account and the income summary account. In bookkeeping the Income Summary account falls into the Income Statement category of accounts and is only used at the end of the time period to close everything out. The Income Summary account is a permanent account. Definitions For Normal Balancenor Reasons To Show Contra Accounts On The Balance Sheet Financial Accounting Company The credit accounts ie.

Source: opentextbc.ca

Source: opentextbc.ca

Income Summary allows us to ensure that all revenue and expense accounts have been closed. This income balance is then. On the other hand expenses and withdrawals decrease capital hence they normally have debit balances. The Income Summary is very temporary since it has a zero balance throughout the year until the year-end closing entries are made. The income summary account is an account that receives all the temporary accounts of a business upon closing them at the end of every accounting period Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual.

Source: accountinguide.com

Source: accountinguide.com

The Income Summary account is used throughout the accounting period. Revenue accounts are closed by making a debit entry to the account and a credit entry to Income Summary. At the end of the accounting year the balances will be transferred to the owners capital account or to a. Answer Correct answer is Sales Sales has a normal credit balance and a closing entry required to transfer sales account to income summary account will require following entry Date General Journal Debit Credit Sales Income s. In a manual accounting system the.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

If the account has a 90000 credit balance and we wanted to bring the balance to zero what do we need to do to that account. Then you transfer the total to the balance sheet and close the account. Definitions For Normal Balancenor Reasons To Show Contra Accounts On The Balance Sheet Financial Accounting Company The credit accounts ie. Some accountants argue that the normal balance of the Income Summary account should be a credit since that would indicate that the firm had a net income. For example an allowance for uncollectable accounts offsets the asset accounts receivable.

Source: opentextbc.ca

Source: opentextbc.ca

Click card to see definition Revenue expense and owners withdrawal. The Income Summary will be closed with a debit for that amount and a credit to Retained Earnings or the owners capital account. The first accounts to close are the revenue accounts. Then you transfer the total to the balance sheet and close the account. Thus you will never see it on any financial statements nor does it have any normal balance sign.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title income summary normal balance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.