Your Business income statements and payment summaries uber images are available. Business income statements and payment summaries uber are a topic that is being searched for and liked by netizens today. You can Find and Download the Business income statements and payment summaries uber files here. Find and Download all free photos and vectors.

If you’re searching for business income statements and payment summaries uber pictures information related to the business income statements and payment summaries uber topic, you have visit the right site. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly search and locate more informative video content and graphics that fit your interests.

Business Income Statements And Payment Summaries Uber. Financial Highlights for Fourth Quarter 2020. Register for GST and make GST payments for BOTH Uber and Deliveroo income and. If you are already making or will make so. Dont have an account.

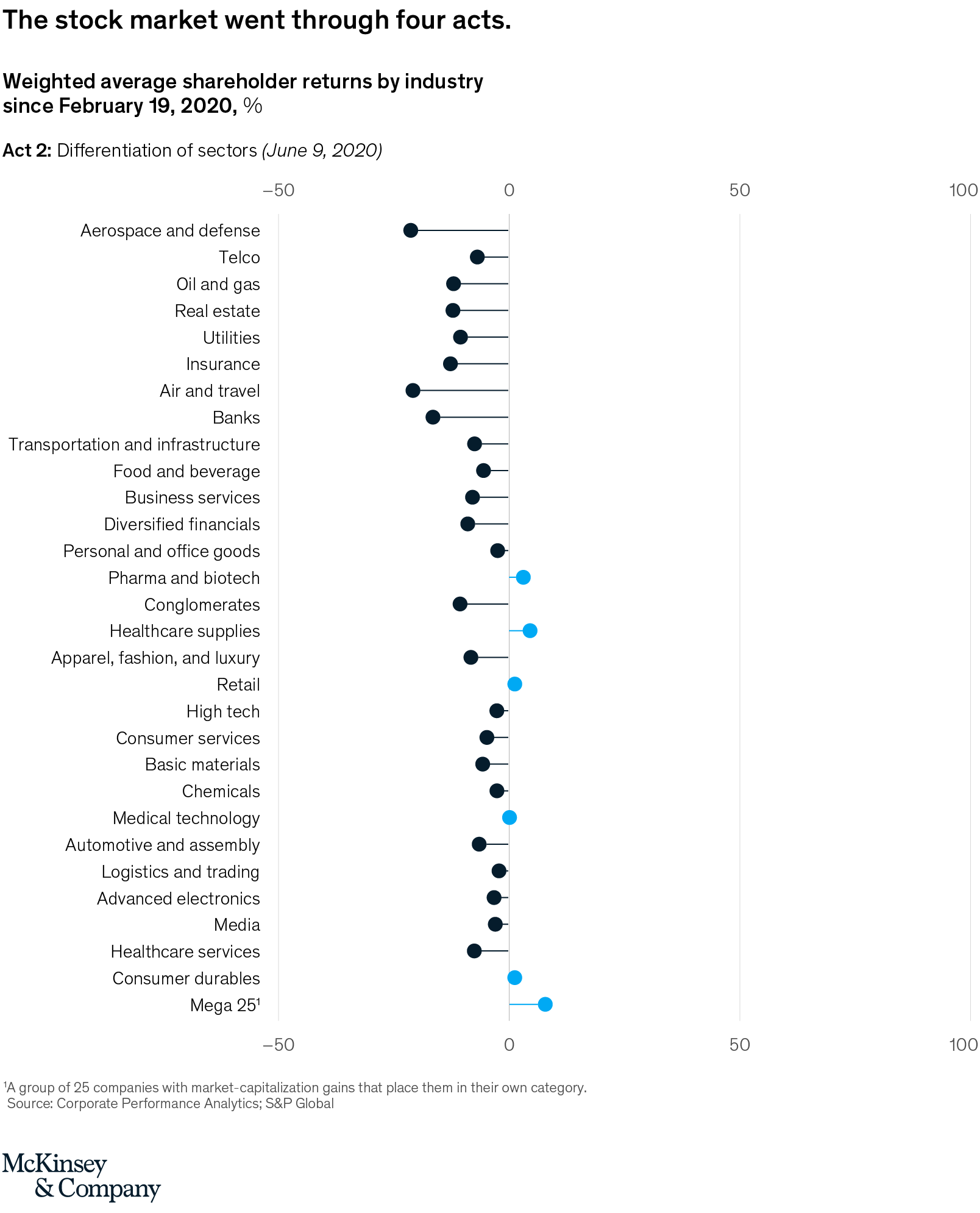

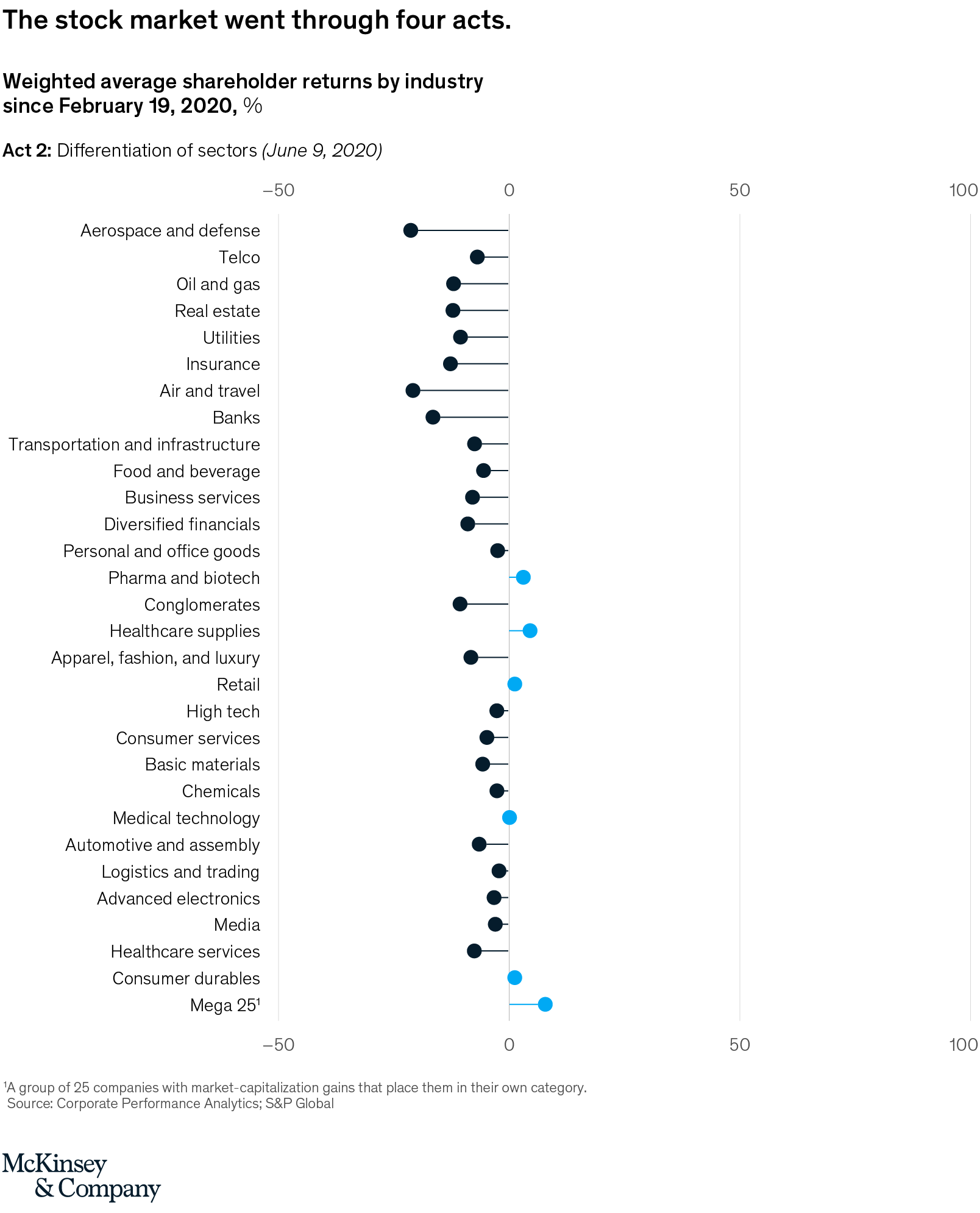

Coronavirus Business Impact Evolving Perspective Mckinsey From mckinsey.de

Coronavirus Business Impact Evolving Perspective Mckinsey From mckinsey.de

What some people dont seem to realize is that even if you dont receive a 1099 youll still need to pay taxes on that income. How GST on Uber Income Is Calculated. Estimated Business use of Motor Vehicle for Ride Share in a given Quarter. For Uber drivers this means 111th of the Gross Fares Split Fare Fees Booking Fees Tips and all other amounts that you receive from the passenger. For the 2019 tax year the self-employment tax rate is 153 of the first 9235 of your net earnings from self-employment. ABN not quoted Voluntary agreement Labour hire or other specified payments.

MyTax will transfer any tax withheld amounts entered in Business income statements and payment summaries and show in the fields.

Have you ever looked at your Uber pay statement and been completely confused. Potential deductible business-related expenses may vary depending on how your business is set up. In other words as a rideshare driver you must pay two different kinds of tax on your rideshare income GST and Income Tax. When will you receive your Uber tax summary in 2021. Primary production Business expenses Enter your primary production business expense amounts into the corresponding fields. What some people dont seem to realize is that even if you dont receive a 1099 youll still need to pay taxes on that income.

The tax summary provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible. ABN not quoted Voluntary agreement Labour hire or other specified payments. By the same token you can claim most of your expenses under both GST and Income Tax. Primary production Business expenses Enter your primary production business expense amounts into the corresponding fields. UBER today announced financial results for the fourth quarter and full year ended December 31 2020.

Source: youtube.com

Source: youtube.com

You are also expected to have done your feasibility studies and market survey before committing your capital in the business. What some people dont seem to realize is that even if you dont receive a 1099 youll still need to pay taxes on that income. It is important to note that starting a standard Uber business with over a handful of cars and drivers also needs a significant investment capital solid planning and concentration to detail in order to keep your business profitable. A Sample Uber Driver. Youll claim the GST portion ie.

How GST on Uber Income Is Calculated. ABN not quoted Voluntary agreement Labour hire or other specified payments. Dont get a 1099 both Uber and Lyft will loose you. The tax summary provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible. Get the detailed quarterlyannual income statement for Uber Technologies Inc.

How GST on Uber Income Is Calculated. Sign In Email or mobile number. Your total earnings gross fares Potential business expenses service fee booking fee mileage etc. Submit a business activity statement BAS. Find out the revenue expenses and profit or loss over the last fiscal year.

When will you receive your Uber tax summary in 2021. Youll receive an Uber tax summary on your driver dashboard before January 31 2022. Corporate - Taxes on corporate income Last reviewed - 10 September 2021 Companies resident and non-resident that carry on a business in Singapore are taxed on their Singapore-sourced income when it arises and on foreign-sourced income when it is remitted or deemed remitted to Singapore. Dont skip out on it just because you didnt earn enough for Uber and Lyft to send you the paperwork. Weve received a lot of emails about Ubers pay statement and how to determine how much youre actually getting paid so today were having RSG contributor Will Preston explain the Uber pay statementHave questions about your pay statement.

ABN not quoted Voluntary agreement Labour hire or other specified payments. Weve received a lot of emails about Ubers pay statement and how to determine how much youre actually getting paid so today were having RSG contributor Will Preston explain the Uber pay statementHave questions about your pay statement. What some people dont seem to realize is that even if you dont receive a 1099 youll still need to pay taxes on that income. The tax benefits of being a Deliveroo rider-partner. In addition to GST you must also pay Income Tax on your Uber income.

Financial Highlights for Fourth Quarter 2020. Corporate - Taxes on corporate income Last reviewed - 10 September 2021 Companies resident and non-resident that carry on a business in Singapore are taxed on their Singapore-sourced income when it arises and on foreign-sourced income when it is remitted or deemed remitted to Singapore. Gross Bookings grew 16 quarter-over-quarter QoQ to 172 billion down 5 year-over-year YoY or 4 on a constant currency basis. 111th of your expenses on your BASs each. Dont get a 1099 both Uber and Lyft will loose you.

Source: mckinsey.de

Source: mckinsey.de

There are a range of tax deductions you can claim as a Deliveroo rider-partner. Sign In Email or mobile number. Financial Highlights for Fourth Quarter 2019. Youll claim the GST portion ie. Your annual Tax Summary should be available on July 7.

You are also expected to have done your feasibility studies and market survey before committing your capital in the business. Weve received a lot of emails about Ubers pay statement and how to determine how much youre actually getting paid so today were having RSG contributor Will Preston explain the Uber pay statementHave questions about your pay statement. As a courier using the Uber Eats app you might be generating income that you need to declare with the tax authorities. The tax summary provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible. Submit a business activity statement BAS.

Below you will find instructions on whether youll need to pay VAT andor income taxes. You were a sole trader or had business income or losses partnership or trust distributions not from a managed fund BusinessSole trader income or loss and either of Personal services income. Sign In Email or mobile number. For the 2019 tax year the self-employment tax rate is 153 of the first 9235 of your net earnings from self-employment. Primary production Business expenses Enter your primary production business expense amounts into the corresponding fields.

Primary production Business expenses Enter your primary production business expense amounts into the corresponding fields. For the 2019 tax year the self-employment tax rate is 153 of the first 9235 of your net earnings from self-employment. Youll receive an Uber tax summary on your driver dashboard before January 31 2022. SAN FRANCISCO–BUSINESS WIRE– Uber Technologies Inc. You are also expected to have done your feasibility studies and market survey before committing your capital in the business.

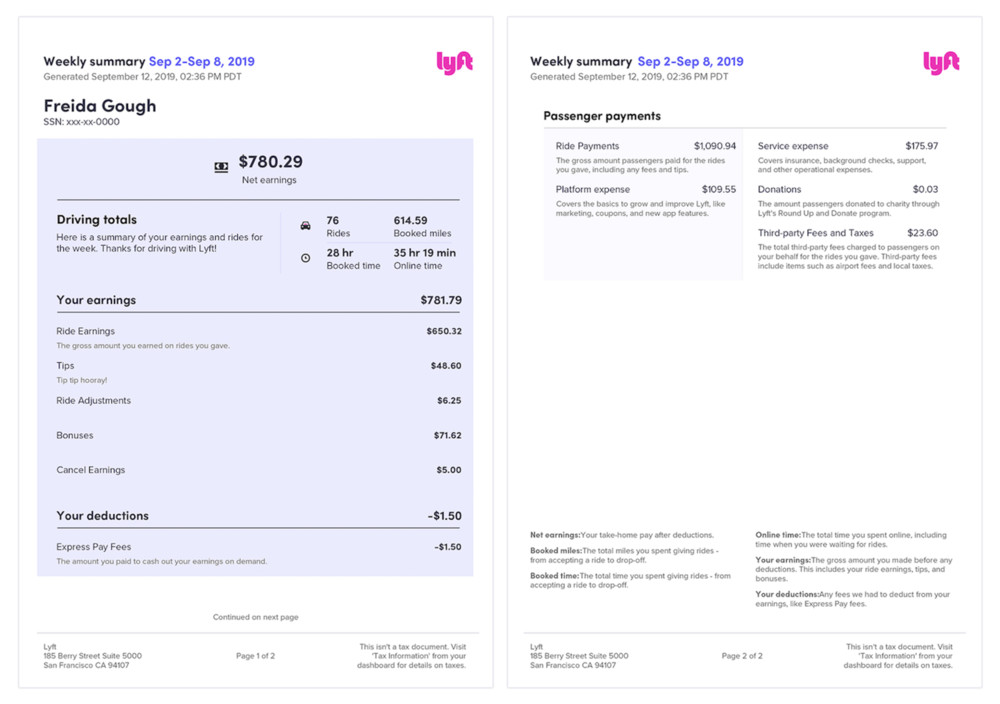

Source: lyft.com

Source: lyft.com

If you have more than 400 in income from your ridesharing work you need to pay self-employment taxes. The tax summary provides a detailed breakdown of your annual earnings and business-related expenses that may be deductible. Your annual Tax Summary should be available on July 7. When preparing and filing their tax returns Uber drivers must complete a T2125. VAT VAT is due if you are self-employed and supplying services for which you are compensated.

By the same token you can claim most of your expenses under both GST and Income Tax. Heres a list of a few work-related expenses that become tax-deductible when you ride for Deliveroo. Corporate - Taxes on corporate income Last reviewed - 10 September 2021 Companies resident and non-resident that carry on a business in Singapore are taxed on their Singapore-sourced income when it arises and on foreign-sourced income when it is remitted or deemed remitted to Singapore. There are a range of tax deductions you can claim as a Deliveroo rider-partner. Your total earnings gross fares Potential business expenses service fee booking fee mileage etc.

Your Tax Summary document includes helpful information such as. Register for GST and make GST payments for BOTH Uber and Deliveroo income and. For Uber drivers this means 111th of the Gross Fares Split Fare Fees Booking Fees Tips and all other amounts that you receive from the passenger. The combine usage of Ola Uber and DiDi must not exceed 95 as 5 is minimum private use of Motor Vehicle in Ride Share Business. UBER today announced financial results for the fourth quarter and full year ended December 31 2020.

Source: investors.biontech.de

Source: investors.biontech.de

If you are already making or will make so. Primary production Business expenses Enter your primary production business expense amounts into the corresponding fields. Weve received a lot of emails about Ubers pay statement and how to determine how much youre actually getting paid so today were having RSG contributor Will Preston explain the Uber pay statementHave questions about your pay statement. MyTax will transfer any tax withheld amounts entered in Business income statements and payment summaries and show in the fields. Find out the revenue expenses and profit or loss over the last fiscal year.

In other words as a rideshare driver you must pay two different kinds of tax on your rideshare income GST and Income Tax. Primary production Business expenses Enter your primary production business expense amounts into the corresponding fields. What some people dont seem to realize is that even if you dont receive a 1099 youll still need to pay taxes on that income. MyTax will transfer any tax withheld amounts entered in Business income statements and payment summaries and show in the fields. Have you ever looked at your Uber pay statement and been completely confused.

All GST-registered businesses in Australia including all rideshare drivers must pay GST of 111th on their business income to the ATO. Even if youve reported self-employment income before ridesharing is a bit different than other businesses. Sign In Email or mobile number. This means you can deduct business expenses to reduce the amount of tax youll owe. The keyword here is net earnings.

Source: mckinsey.de

Source: mckinsey.de

Financial Highlights for Fourth Quarter 2020. As a courier using the Uber Eats app you might be generating income that you need to declare with the tax authorities. Your annual Tax Summary should be available on July 7. Advertising Insurance Wages Supplies Utilities Loan payments Etc. This form is known as a statement of business activities.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title business income statements and payment summaries uber by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.